UPDATE 10/30/25: OFAC added 25 new bitcoin addresses to Chen Zhi’s SDN listing. These addresses represent additional crypto wallets controlled by the Prince Group leader beyond the four addresses initially designated on October 14, 2025. The newly designated addresses include both legacy bitcoin addresses (beginning with “3”) and native SegWit addresses (beginning with “bc1q”), expanding the scope of Chen Zhi’s known crypto holdings used in connection with the Prince Group’s massive pig butchering and money laundering operations. The new addresses included account for over $850 million in additional received funds; the current balance of all these wallets exceeds $780 million:

- bc1qeth6n6ryxexvkx34wnx3nuynun4474h3j0gkhw

- bc1q2we5eqjj8je6lz9xwjattpc3pn4jejc5h0s70f

- bc1qnujzvts45qka3cr2eqqw8ur3q6g6s0ze2wlk5m

- bc1qw4fxztd5u3sl7vrcqwk2a8v5zh5dllvckx3tlt

- 3EynPFpoGTPxU9m5bPaEDEUxUanzh7vgQP

- 3FoD1f6Tfnq3s8MYHgJqFPWv9cUrtUdBSv

- 3MKXKqPXf6VxTLkVSXuDKzaTiZZaz5AmiK

- 386sPhHBbLidzPnoxUH74jiiYkHYtobefQ

- 35irs2AU6pVgenYbWvMRz22avDBLC9XMkd

- 36ia8qAE1k1PKQePdXENCm1YKLXxZyVnnc

- 374RguZDMNW5Zh5ouW3KhKDcrerKusmsuk

- 3CuqLrZWn5oCe6DRScdRwiFv8txcahrsG3

- 3MNWiGeoKAhtTrbJuUXpvSRYJSNvmyJSWE

- 39HJB4x6W5QuKFEuV1tfcfNveLRJTzcC12

- 3L1PSCgfPKJAfQCZcoKfbvWf1fBmWM1Bbs

- 3D44E2Z3PcLa868GeBNiP5E2GPTfVLULUJ

- bc1qnq3pzsw3elkecrw8pqrz70r7zuse6cwyxa6dhc

- bc1qeaxuj8vamvnxqveleaqgmae33x904xuzj836p3

- bc1q66y45cq78ke25kz7rpe94l84avt7zetglzeeqg

- bc1qu8mcqffx3jpdwnap88h85u5l5l0xq97438tz2x

- bc1qw75cxmxz4e2v265mue9wmqgq2m0qdyr25l2ufl

- bc1q7des766x6c0zkycz6dz6rfv066n3fcg4kggtrt

- bc1qlwtksgusw8pp3k3a39mkmwvswujhhgn0ulp3uj

- bc1qu4p4eynzu8vwwcv0yxq74gth00exjyech05uf0

- bc1qw0pswznckx7s6tjmd2f5hrx4q6kc5nyrdxku50

- bc1q9kja7t2zxz0ze4lcgxf0l07pygpc69ws528lj9

- bc1qea942uw640l7nvtf3vplv6jd6wvuy06c58cd4k

- bc1q6qze6uj6jncgnva4eghxn3tr4pm2frh77ad3k9

- bc1qcx8vxxrld2s7qvz64qp75s3508rkzaxj65l60q

TL;DR

- OFAC has designated the Prince Group TCO and 146 associated targets for operating massive “pig butchering” scam operations, including individual Chen Zhi.

- The network’s crypto operations include bitcoin mining through Warp Data Technology and the laundering of scam proceeds.

- Huione Group, a key financial services provider, has been cut off from the U.S. financial system after laundering over $4 billion in illicit crypto proceeds, and has processed over $98 billion of total cryptocurrency inflows over the past four and a half years.

- The U.S. Department of Justice (DOJ) launched a record-breaking forfeiture case involving $15 billion in bitcoin held in U.S. custody.

On October 14, 2025, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) and Financial Crimes Enforcement Network (FinCEN), in coordination with the United Kingdom’s Foreign, Commonwealth, and Development Office (FCDO), took action against cryptocurrency-enabled scam networks operating in Southeast Asia. The designation includes the Prince Group Transnational Criminal Organization (TCO) and its vast network of companies and individuals, including Chen Zhi, involved in cryptocurrency scams, mining operations, and money laundering. As part of the broader network, the U.K.’s Office of Financial Sanctions Implementation (OFSI) also sanctioned Byex Exchange, a cryptocurrency exchange platform with links to both Jin Bei Group Co. Ltd and Prince Group.

As part of the action, Huione Group, which was subject to a Notice of Proposed Rule Making (NPRM) on May 1, 2025, has now been designated under FinCEN’s Special Measures as a primary money laundering concern under Section 311 of the USA PATRIOT Act, officially severing the firm’s access to the U.S. financial system.

In addition, the U.S. Department of Justice (DOJ) has unsealed an indictment against Chen Zhi, also known as “Vincent,” the founder and chairman of Prince Holding Group (Prince Group). The DOJ also filed a historic $15 billion civil forfeiture complaint involving approximately 127,000 bitcoin linked to the fraudulent schemes.

Cryptocurrency at the center of operations

A luxury hotel and casino operation tied to the Prince Group, Jin Bei Group Co. Ltd., has been linked to a series of criminal activities across Cambodia, including extortion, forced labor, large-scale scamming, and the brutal 2023 murder of a 25-year-old Chinese national. In a 2022 U.S. takedown of a Chinese money laundering network, the FBI identified 259 Americans who lost a total of $18 million to scammers operating within Jin Bei compounds, which is just a fraction of the broader financial harm attributed to the group. Despite efforts by Prince Holding Group to disassociate itself, public records and a June 2025 Cambodian government press release confirm that it owns Jin Bei Casino, with Chen Zhi named as CEO.

Chen Zhi and a network of high-ranking associates used a web of companies and subsidiaries to coordinate money laundering, investment fraud, forced labor, and other serious crimes across Southeast Asia. Individuals close to Chen Zhi, including real estate executives, financial operatives, and shell company owners are accused of moving illicit funds, overseeing scam compounds, and facilitating violence to maintain control.

Prince Group’s reach extends far beyond Cambodia, including into Palau, where it reportedly attempted to launder its image through high-end resort development. With the help of Rose Wang, a Palau-based figure linked to organized crime, Prince Group secured a 99-year lease on Ngerbelas Island to build a luxury resort under a front company called Grand Legend. The OFAC press release highlights that this expansion was part of a broader effort to legitimize profits from criminal enterprises while maintaining deep ties to known underworld figures.

At the heart of the operation were four bitcoin addresses directly controlled by Chen Zhi, the organization’s leader, amassing over $1.77 billion in bitcoin over the past two and a half years:

- bc1qeth6n6ryxexvkx34wnx3nuynun4474h3j0gkhw

- bc1q2we5eqjj8je6lz9xwjattpc3pn4jejc5h0s70f

- bc1qnujzvts45qka3cr2eqqw8ur3q6g6s0ze2wlk5m

- bc1qw4fxztd5u3sl7vrcqwk2a8v5zh5dllvckx3tlt

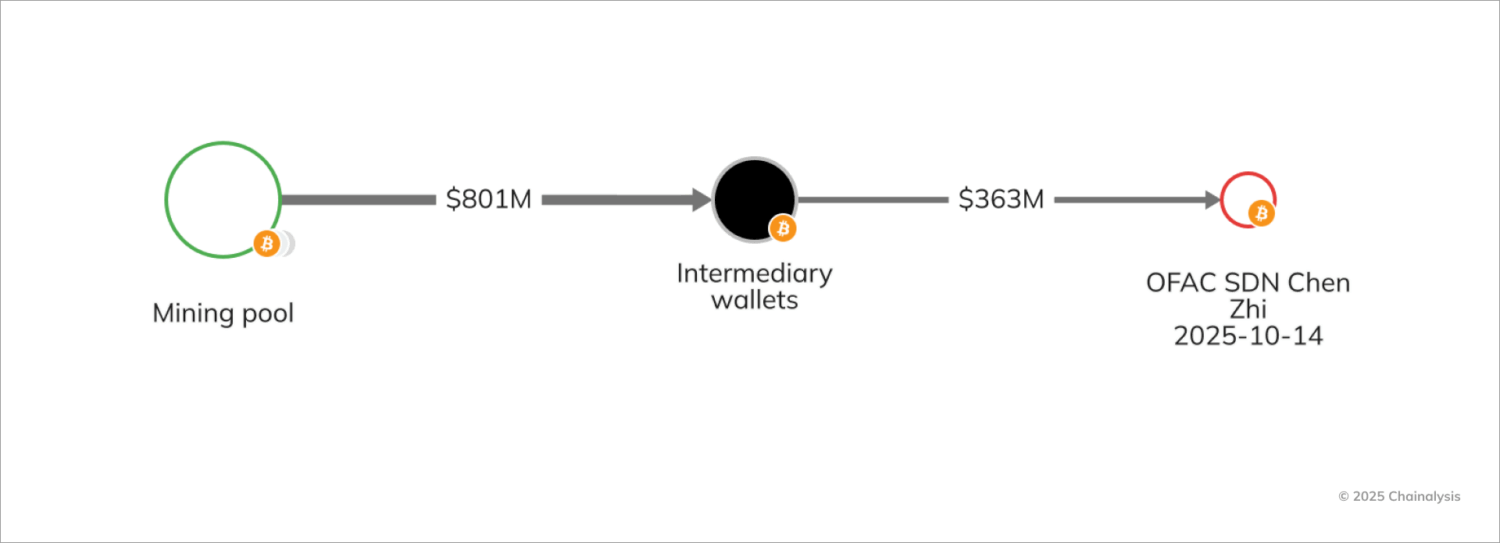

The organization also operated a dedicated bitcoin mining operation in Laos through Warp Data Technology, which funneled large quantities of bitcoin to wallets controlled by Chen Zhi. This mining operation worked in concert with the group’s “pig butchering” scams, where victims were convinced to invest in fraudulent crypto platforms, and their complex money laundering operations conducted through a network of over 100 shell companies. As seen in the Chainalysis Reactor graph below, Chen Zhi’s wallets received extensive inflows indirectly from a mining pool:

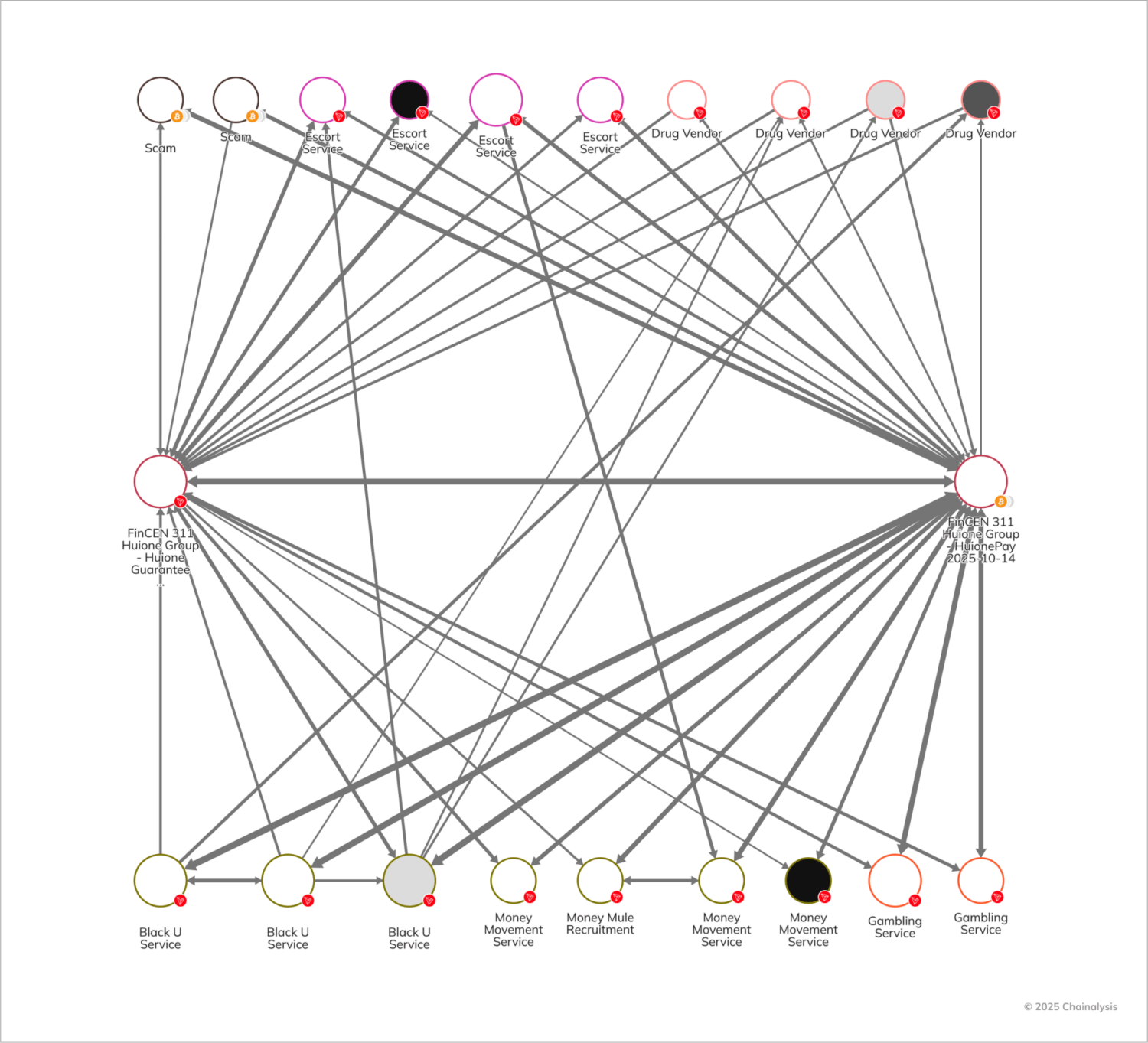

The scale of the crypto-enabled fraud is staggering. Through Huione Group alone, authorities identified over $4 billion in illicit proceeds laundered between August 2021 and January 2025, including $37 million from North Korean cyber heists, $36 million from crypto investment scams, and $300 million from other cyber scams. Huione Group has also processed over $98 billion of total cryptocurrency inflows within that time frame, including to a host of illicit actors, as we’ve previously highlighted, including money launderers, escort services, drug vendors, and more.

The above graph only scratches the surface of Huione Group’s facilitation of illicit activity, which has extended to sanctioned entities, jurisdictions, and a host of various illicit cryptocurrency-related activity.

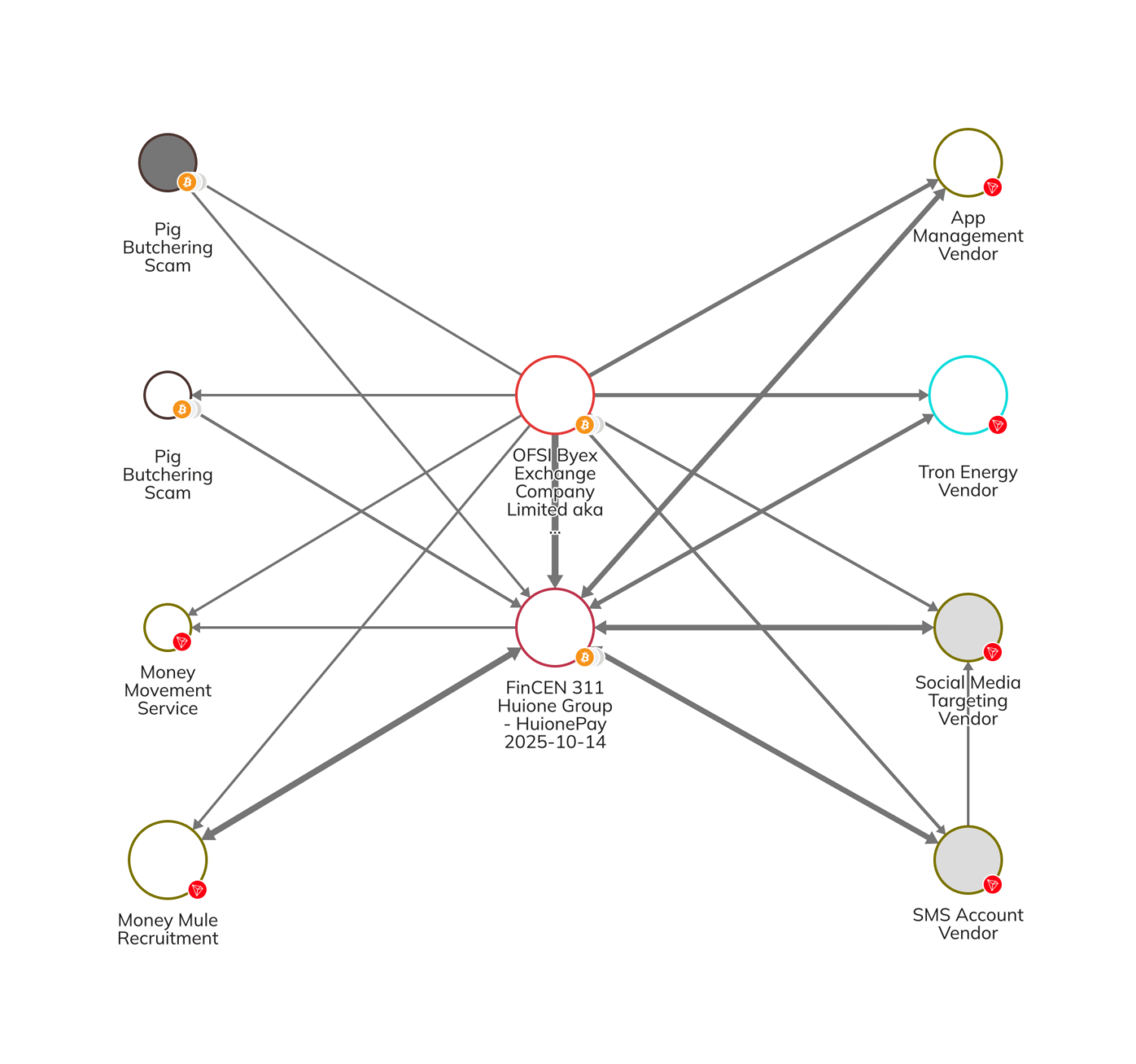

Lastly, OFSI’s action against Byex Exchange further highlights the network utilized by Prince Group and Jin Bei. As seen in the Reactor graph below, Byex has interacted directly with Huione; and facilitated pig butchering scam payments, scam technology vendors such as social media targeting and SMS account vendors, and money movement services which help facilitate laundering of illicit proceeds.

Impact on cryptocurrency compliance and asset recovery

Today’s action represents the largest-ever coordinated effort targeting crypto-enabled scam networks in Southeast Asia, including a historic $15 billion bitcoin seizure. This landmark recovery demonstrates the growing capability of law enforcement to trace and seize illicit cryptocurrency assets, which Chainalysis estimates could amount to hundreds of billions of dollars globally.

To protect against these types of scam networks, crypto businesses should screen transactions against newly designated entities and individuals, monitor for typical “pig butchering” scam patterns, and be alert to connections with Huione Group, which is now cut off from the U.S. financial system.

We have updated our screening solutions to include all designated individuals and entities from today’s action and will continue monitoring for additional cryptocurrency addresses and entities connected to these networks.

If you’d like to learn more about Chainalysis products, click here to request a demo.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.